Before colonial rule, many African households survived on cattle ranching. These families stored their wealth in cattle and used them to pay taxes and other expenses. However, colonial rule changed the economic landscape of Africa. The colonialists required African labour to build new towns, railways, and mines. As a result, many African households were forced to send members to work for the colonialists to raise the cash they needed to pay the new taxes. This dependence on African labour helped to develop the colonial economy but at the expense of the traditional African way of life.

What is a Hut Tax?

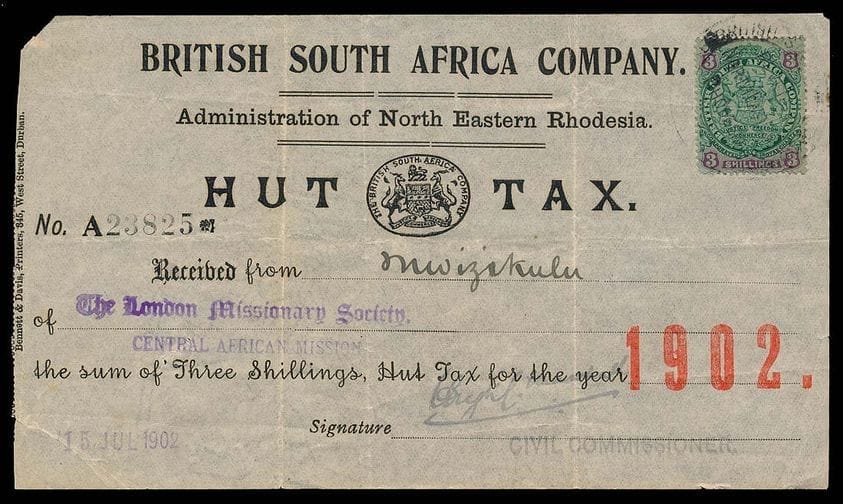

The history of the hut tax is a long and complicated one, stretching back to the late 19th century. The tax was originally imposed in British colonies as a way of raising revenue, and it proved to be quite controversial. In Sierra Leone, for example, the tax sparked the Hut Tax War of 1898, in which substantial damage was sustained to the establishments of the Home Missionary Society. The war ultimately led to the abolishment of the tax in Sierra Leone.

The hut tax was a type of taxation introduced by British colonialists in Africa on a per hut or household basis. It was variously payable in money, labour, grain or stock and benefited the colonial authorities in four related ways: it raised money; it supported the currency; it broadened the cash economy, aiding further development; and it forced native Africans to labour in the colonial economy.

The tax was particularly burdensome for rural families who often relied on their huts for shelter and were unable to pay the tax in cash. As a result, many were forced to sell their belongings or take out loans to pay the tax. The hut tax was also an important source of revenue for the British colonial governments and helped to finance the development of infrastructure and other public services. However, the tax also hurt African economic development and perpetuated inequality between colonists and native Africans.

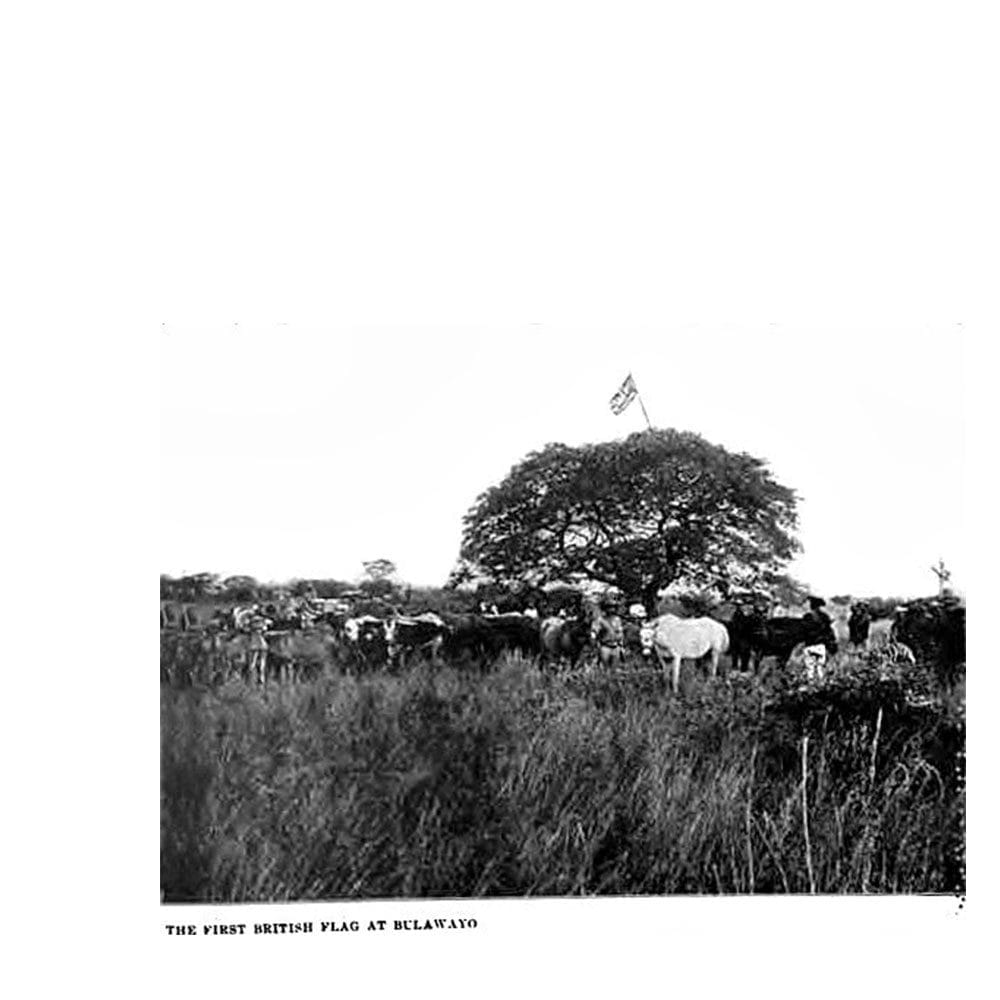

Discouraging ‘idleness’ in Rhodesia

In 1896, the British South Africa Company introduced a hut tax in Northern and Southern Rhodesia (now Zambia and Zimbabwe). The tax was levied on every African man over the age of eighteen and was payable in either cash or kind. The stated purpose of the tax was to ‘discourage idleness’, but it also forced more Africans into the wage labour market.

Ten shillings extra for every wife over one

Although the Native Tax in Southern and Northern Rhodesia was not technically a “hut tax,” it still applied to all adult males regardless of their status. The rate per annum for each native male was £1, with an additional ten shillings if the individual was married or had more than one wife living under his roof.1

There was no hut tax in Southern Rhodesia, but there was an additional fee for every able-bodied man over the age of eighteen who wishes to work in mines or on white-owned farms. This fee was usually paid by the employer, but could also be deducted from the wages of the workers.

The end of the hut tax in Zimbabwe

While the hut tax was originally introduced to finance public works and administration, it quickly became clear that it disproportionately impacted African households. The tax was widely resented and led to several uprisings over the years.

In 1964, the Rhodesian government abolished the hut tax. The abolition of the tax was seen as a victory for African nationalists and helped to contribute to the eventual independence of Rhodesia (now Zimbabwe).

Sources

1. Api.parliament.uk. 1909. Rhodesia and Nyassaland Hut Tax. (Hansard, 29 June 1909). [online] Available at: <https://api.parliament.uk/historic-hansard/commons/1909/jun/29/rhodesia-and-nyassaland-hut-tax> [Accessed 22 July 2022].